Fake check scams are one of the most common types of fraud committed against consumers. Here we will discuss what a fake check scam looks like and how to prevent falling for one.

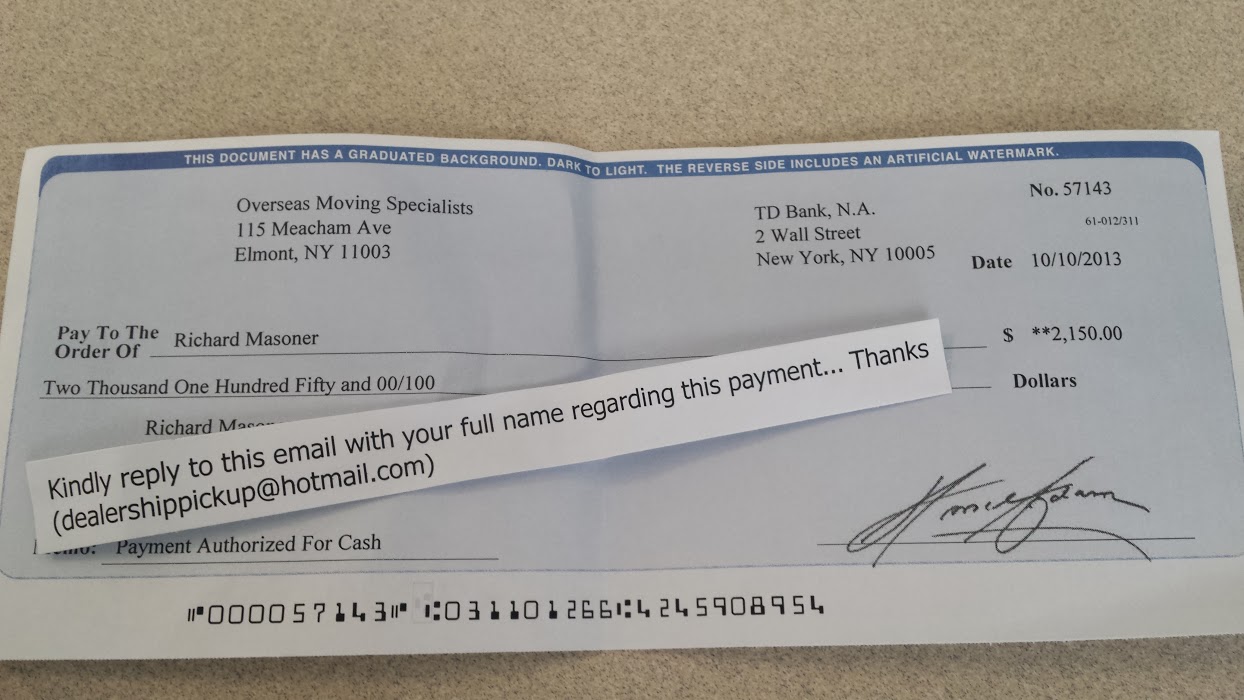

Have you recently received a check with a request from the sender to send funds back to them? If you answered “yes” to that question, it is imperative that you understand that this is a scam.

Despite the integration of technology into our financial lives, many individuals still lean towards cashier’s checks and bank checks as they are often viewed as more secure; however, this is not always the case.

If the document is fake, the paper check is not a secure form of payment and the funds are not guaranteed. Out of all financial-based scams, fake check scams are considered to be one of the most common types of fraud committed against consumers.

What is a Fake Check Scam and How Does it Work?

A fake check scam starts when a consumer receives a paper check, cashier’s check, or money order from someone they don’t know. They are asked to wire back a portion of that check to the person that sent it or to another party.

If the recipient cashes the check and successfully returns a portion of it back to the person committing fraud, they may be liable for that amount of money.

The issue is, this normally transpires before the consumer realizes that it is a scam.

All banks are required to make funds quickly available by law. It could take days or weeks for the bank to realize that the check is “bad”. In the meantime, the scam artist receives the money and the consumer is held responsible.

Are There Different Types of Fake Check Scams?

Yes, there are different variations when it comes to fake check scams. The following outlines the most common methods that scammers use to target consumers while engaging in this financial scam:

- Many scam artists may promise to pay you to do a work at home or virtual job.

- It is possible for a check scam to occur through the means of a scammer buying something that you have advertised that you wish to sell.

- Many scammers may state that you have won a sweepstakes or a lottery and that they are providing you with an “advance” on the amount that you are due from the win.

- Scammers will send a notice informing the recipient that they have access to millions of dollars; however, before being able to spend that money, it must be transferred from a foreign country to the recipient’s bank account. It is often said that this is done for “safekeeping” of the funds.

How Can I Protect Myself Against Fake Check Scams?

There are several steps that you may take to protect yourself against fake check scams. These include the following:

- Take the check to your bank. The staff will be able to identify whether or not it is fraudulent. You should never deposit a check from an unknown sender prior to having it verified by your bank.

- Avoid being fooled by the appearance of the document. Sophisticated technology may have been utilized to create a fake check.

- If the check was issued by a bank, you may use BankFind to determine if the financial institution is real. If you discover it is a real bank, contact them directly to determine if they have issued a check in your name. You should verify both the reason for the check and the amount.

- Pay close attention to the postmark on the envelope associated with the check. Is it in the same city or in close proximity to the issuer? If not, it is likely a scam. Additionally, you should be very cautious of checks that were mailed from foreign countries – especially if you have no legitimate ties with that country.

- Look for security features on the check that you have received. These may include security threads, inks that change colors, and watermarks. While it is true that these may be duplicated by fraudsters, it is usually low in quality.

Let Us Help

Why subject yourself to fraud? The fake check scams currently in existence may prove to be very costly. If you receive a questionable offer, contact us at Somerville Bank immediately. We can assist you in determining if you have been hit by a scammer.

Visit us at one of our many locations today: https://somervillebank.net/locations/

Somerville Bank has 8 Locations

Somerville Bank has 8 Locations